tax the rich meaning

In Bexar County where US Global Investors is headquartered home values have. This includes the total value of personal assets including cash bank deposits real estate assets in insurance and pension plans ownership of unincorporated businesses financial securities and personal trusts a one-off levy on wealth is a.

Tax Deductions For Artists Infographicbee Com

21 trillion over 10 years.

. Raise capital gains taxes. Bill Clinton and his allies in Congress cut taxes on investments deregulated Wall Street and. When we say we want to Tax the Rich we dont mean the guy busting his back running a local diner.

But by any reasonable definition the amount paid by the rich is already beyond their fair share. The most recent proposals by Bernie Sanders and Elizabeth Warren specifically targeted taxing wealth. TAX THE RICH is part of my ongoing work in support of the need for a fundamental shift from free-market capitalism to a new way of being thats rooted in compassion generosity and true equality for all beings.

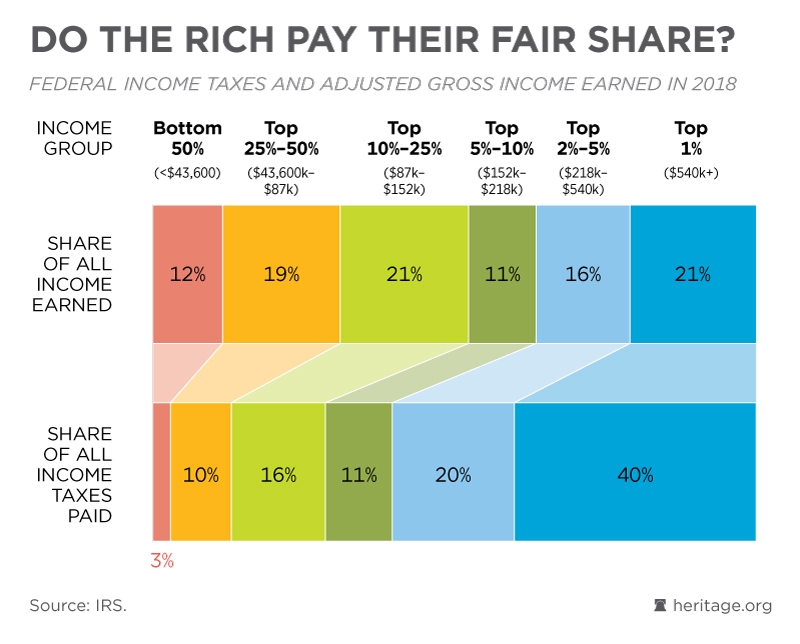

Not only do the rich pay taxes but high-income earners pay a higher rate of income tax. HUNDREDS of thousands of homeowners in Texas have made their voices heard after receiving their 2022 home appraisals says Frank Holmes at US Global Investors. As a group the rich pay the largest share of all.

Democrats increased the 100000 SALT cap to 72500 in their bill providing wealthy taxpayers with tens of thousands of dollars per year in tax benefits. The best trick the 001 percent ever pulled was convincing the 99 percent that its the. Taxing the rich can mean at least three things.

In 2018 for example the top 1 percent of taxpayers paid 401 percent of all federal income. Judgments may differ but one thing is certain. We mean people who complain about having to pay taxes but seem to think throwing around 43 billion dollars to attempt to buy all.

Taxing high-income earners taxing capital income because most of the income of the super-rich comes from capital income or taxing the stock of wealth directly. The question to AOC was raised in the wake of the congresswoman wearing an emblazoned Tax the Rich dress to the Met Gala where tables could reportedly cost more than 275000 and individual tickets are priced at around 30000. None of the benefits from the SALT repeal go to lower-income Americans so occupants of the penthouse cheer while the building janitor gets.

Thats a crazy thought. In 1950 the top 001 of earners paid almost 70 of their income in taxes. Note the subtitle of her article.

Tax the Rich. The meaning of eat the rich is that when poor people have to do what it takes to survive there will come a time when they eat the rich. The average middle-class household gets just 15.

Those 160 families not a single one is a celebrity or athlete. In the late 20th century the Democratic Party moved to the right on economic policy. And two thirds of.

Inflated house prices targeted by Texas. We mean the guy who owns half the town. They pass the added tax costs to customers employees and shareholders.

On Monday House Democrats unveiled new proposals aimed at increasing taxes for the wealthiest Americans and corporations. So for instance Tom Brady kind of money isnt shit compared to these people. By 2018 the super-rich paid proportionately less than the average for all other Americans.

It doesnt mean to eat the people and the full quote is when the people shall have nothing more to eat they will eat the rich. The top marginal income tax rate would rise to 396 up from 37 and would apply to single filers with taxable income greater than 400000 and. A wealth tax also called a capital tax or equity tax is a tax on an entitys holdings of assets.

AOCs Tax the Rich dress at Met Gala draws mixed reactions. Heres how the Democrats want to tax the rich. It means that if the rich people abuse their wealth and.

People who earn 200000 or more pay more than half of total income taxes. The current model puts profit before all else and is literally destroying the environment health and wellbeing of the planet and. Even through a flat tax under which the rich pay the same tax rate as lower earners the wealthy will still end up paying more in absolute terms since they have a higher amount of income to tax.

We mean the lady with a yacht so big she can park another yacht inside it. How much more the rich would pay. Capital gains and dividends are now taxed at a top rate of 238 percent much lower than the top rate of 37 percent on ordinary income.

Former President Donald Trumps signature tax bill lowered.

Robinhood Stole From The Rich Ruling Class Who Exploited The Poor Working Class And Most Of The Time He Attacked The Tax Collectors Relatable Truth Humor

Hiring A World Class Tax Professional The Wealthy Accountant Finance Blog Money Saving Advice Mr Money Mustache

Tax The Rich Contrast Coffee Mug Old Navy Mugs Coffee Mugs Hot Drink

Why Do You Want To Become Rich Money And Wealth Explained Oddball Wealth How To Become Rich Wealth Finance Blog

Nick Sutton On Twitter Budget Meaning Budgeting George Dragon

Tax Filing 101 For U S Expats Living Abroad Infographic Filing Taxes Tax Tax Prep

100 Editable Financial Money Quotes Financial Coaches Etsy

Why Higher Income Does Not Mean You Re Wealthy And Find Out Why Melissa Houston

How To Win At Money With Tax Refunds Rho Thomas Debt Payoff Tax Refund Personal Finance Lessons

Rep Alexandria Ocasio Cortez Wore A Tax The Rich Dress To The Met Gala

What Does It Mean To Be Hood Rich Personal Finance Bloggers Hood Rich

Taxing The Rich Princeton University Press

Economists Say We Should Tax The Rich At 90 Percent

Do The Rich Pay Their Fair Share Federal Budget In Pictures

Micro Business And Side Gig Tax Guide The Wealthy Accountant

Businessleaderss Shared A Photo On Instagram Remember Just Because They Follow You Doesn T Mean They Support You You Are Your Biggest Supporter Act Like It Sep 12 2020 At 12 42am Utc